If you’ve ever tried to start your estate plan, you’ve probably heard the terms living will, living trust, and will used interchangeably. It’s easy to mix them up — they sound similar, but they serve very different purposes. Each plays a unique role in protecting your health, property, and family’s peace of mind.

At Silvers Law, P.A., we guide Clearwater families through these distinctions every day. Understanding how these documents work together is the key to a complete, well-structured estate plan.

Key Takeaways

- A living will protects your medical wishes while you’re alive.

- A living trust manages and distributes your assets during your lifetime and after death.

- A will (or last will and testament) outlines who inherits your property after you pass away.

- Working with an estate planning attorney ensures these documents complement one another under Florida law.

What Is a Living Will?

A living will is not about property — it’s about healthcare. It’s a legal document that tells doctors and loved ones what kind of medical care you want if you’re unable to communicate. It covers choices like life support, artificial nutrition, and end-of-life care preferences.

In Florida, a living will must be signed in front of two witnesses, one of whom isn’t related to you. It only takes effect when your doctor determines you can’t make your own medical decisions.

Having a living will ensures your care reflects your personal values — and spares your family from having to make those painful choices.

What Is a Living Trust?

A living trust, also called a revocable living trust, is a legal arrangement that allows you to transfer ownership of your assets into the trust while you’re still alive. You (the grantor) maintain control as the trustee and can modify or revoke it at any time.

The main purpose of a living trust is to:

- Manage assets during your lifetime

- Avoid probate after death

- Keep financial matters private

- Ensure a smooth transfer of property to your beneficiaries

When you pass away, your successor trustee steps in to distribute the assets according to your instructions — without court involvement.

Many people in Clearwater choose a living trust for its flexibility and efficiency, especially when owning property in multiple states or wanting to minimize delays for loved ones.

What Is a Will?

A will, also known as a last will and testament, is the traditional document that outlines who inherits your property after death and who will handle your estate (the personal representative).

A will can also:

- Appoint guardians for minor children

- Specify funeral wishes

- Distribute personal items, gifts, or charitable donations

In Florida, a will must be signed by you and two witnesses in your presence. After your passing, it goes through probate, the court-supervised process of verifying your will and distributing assets.

Unlike a living trust, a will becomes public record after probate.

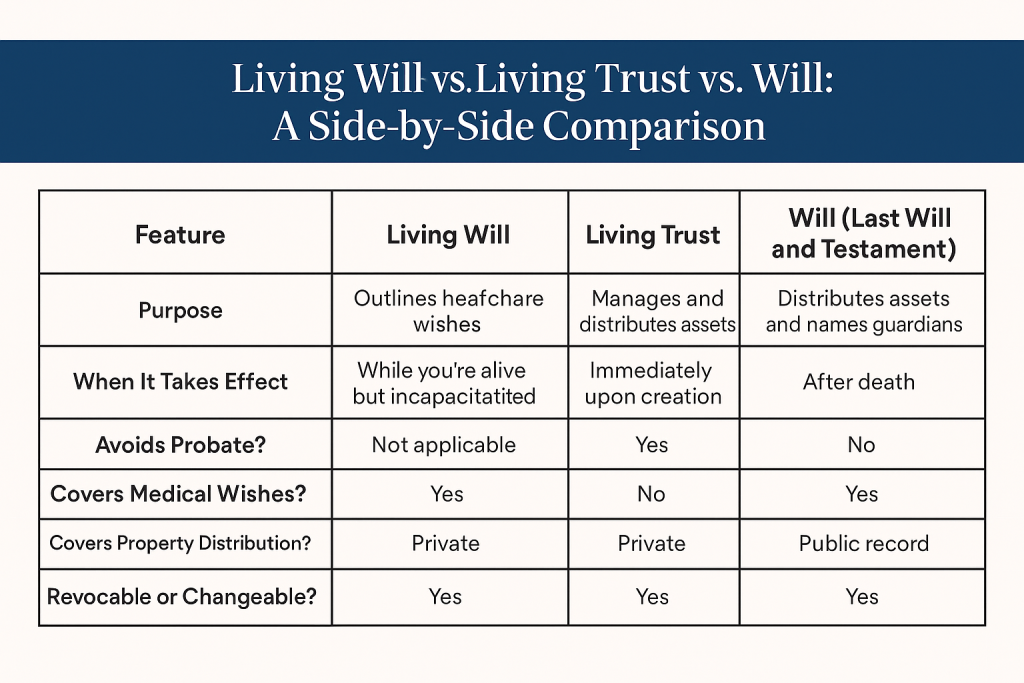

Living Will vs. Living Trust vs. Will: A Side-by-Side Comparison

| Feature | Living Will | Living Trust | Will (Last Will and Testament) |

|---|---|---|---|

| Purpose | Outlines healthcare wishes | Manages and distributes assets | Distributes assets and names guardians |

| When It Takes Effect | While you’re alive but incapacitated | Immediately upon creation | After death |

| Avoids Probate? | Not applicable | Yes | No |

| Covers Medical Wishes? | Yes | No | No |

| Covers Property Distribution? | No | Yes | Yes |

| Privacy | Private | Private | Public record |

| Revocable or Changeable? | Yes | Yes | Yes (with formal updates) |

How These Documents Work Together

For complete protection, most Floridians need all three. Here’s how they fit into a comprehensive estate plan:

- The living will protects your healthcare wishes if you can’t speak for yourself.

- The living trust manages your assets efficiently during life and after death.

- The will ensures remaining assets not in your trust are distributed properly.

At Silvers Law, we often integrate all three so that your financial, medical, and family needs are fully addressed — leaving no uncertainty for your loved ones.

Why You Should Work with an Attorney

While templates for these documents exist online, they rarely meet Florida’s legal requirements or address your unique circumstances. An experienced living will attorney or estate planning lawyer ensures everything aligns correctly, avoiding costly mistakes or court delays later.

We’ve seen how small oversights can create big problems for families. That’s why Silvers Law takes time to understand your values, family structure, and long-term goals before preparing any document.

Our Clearwater team helps with:

- Drafting and reviewing living wills and advance directives

- Creating living trusts to manage property and avoid probate

- Preparing last wills and testaments that reflect your wishes precisely

Frequently Asked Questions

Do I need all three documents?

Yes. Each covers a different aspect of your life — medical, financial, and post-death decisions. Having all three ensures full protection.

Can I update these documents later?

Absolutely. Life changes like marriage, divorce, or new property ownership often require updates.

Does a living trust replace a will?

Not entirely. You still need a will to cover assets not placed in your trust and to name guardians for children.

Is a living will legally binding in Florida?

Yes, when signed with proper witnesses. Healthcare providers must follow it as long as it meets state law.

Can my living will and living trust work together?

Yes. They address different concerns but work best as part of a unified estate plan.

Let’s Build a Plan That Protects You and Your Family

At Silvers Law, P.A., we believe estate planning isn’t about documents — it’s about people. It’s about protecting what matters most and making sure your wishes are honored when it counts.

Whether you’re preparing your first living will, setting up a living trust, or updating your will, we’re here to help every step of the way with clarity, compassion, and experience.

Contact Silvers Law, P.A. today to schedule a consultation and create an estate plan that gives you and your loved ones true peace of mind.